Ed-Tech Market Trends and Investment Opportunities

The ed-tech market is sometimes incorrectly evaluated by analysts who inflate investors’ expectations and tout unbelievable numbers.

For instance, according to a prediction from 2016, ed-tech investments were supposed to reach $252 billion by 2020. It is 2020 now and, so far, only $11.6 billion has been invested in the first half of the year, as reported by Metaari. This is twenty times less than the predicted number. Besides, nearly 20% of that money went to just two Chinese online learning giants, so there appears to be even less opportunity up for grabs in the rest of the world.

So let’s analyze the ed-tech market, paying attention to what is actually considered ed-tech (should we include student loan companies? What about VR apps?) and define distinct observable trends.

Quantifying the ed-tech market

Global expenditure on ed-tech

According to research, only 2.6% of all the money that goes towards education globally is spent on technology. That includes not only software products, but also computers, tablets, and other equipment. All in all, ed-tech spend reached $152 billion in 2018 and is projected to nearly double by 2025.

Global investment in ed-tech

It’s hard to tell exactly how much money is being invested in education technology, because the numbers vary depending on who you ask. Research companies take different approaches to marking the boundaries of the ed-tech industry.

Some analysts factor in investments in student loan companies, while others don’t. Some incorporate solutions that facilitate corporate knowledge-sharing, while others don’t. So depending on where you draw the line, you end up with different numbers.

Let’s look at the breakdowns by two reputable ed-tech market researchers: Metaari and Holon IQ.

Metaari categorises ed-tech investments by learning technology type:

- Self-paced eLearning

- Digital reference-ware (video, audio, eTextbooks)

- Collaboration-based products (online tutoring) – #2

- Mixed reality learning

- Game-based learning

- AI-based learning – #1

- Location-based learning

- Cognitive learning

- Mobile learning – #3

- Robotic tutors

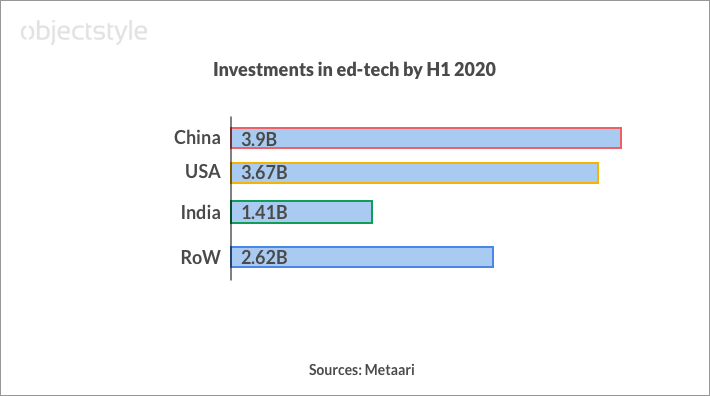

According to Metaari’s whitepaper, $11.6 billion was invested in ed-tech in H1 2020 worldwide.

Holon IQ, another well-known researcher, often categorizes ed-tech companies in the following way:

- Learning content and resources

- Workforce and upskilling

- STEAM and coding

- Language and literacy

- Education financing

- Exams and test prep

- Teachers and students support

- Games and simulations

- AI and robotics

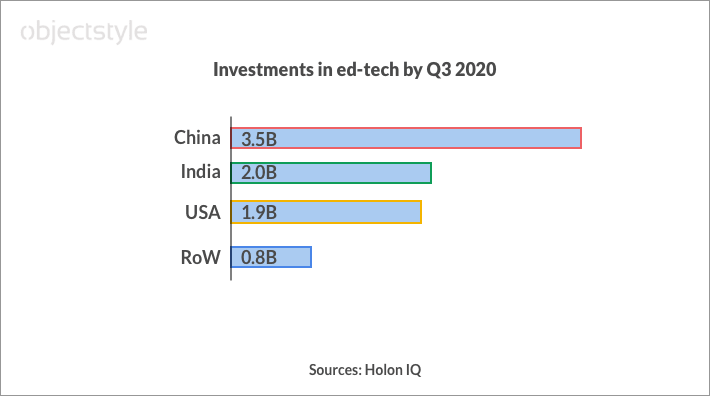

According to a Holon IQ report, $8.3 billion was invested in ed-tech after Q3 2020.

Geography of ed-tech investments

Both Metaari and Holon IQ analysts agree that the three countries leading the ed-tech investment charts are China, the US, and India. However, India’s large number may be an anomaly, since a big share of that money went to just one startup, BYJU’s. (BYJU’s is an online learning app developed by Byju Raveendran, a Kerala-born math prodigy. It got funding from a number of well-known investors, including the Chan Zuckerberg Initiative, among others.)

According to Metaari, there is a tendency for Chinese ed-tech companies to strive to escape strict domestic regulations by gaining presence outside Mainland China. Many file for IPO in Hong Kong or the US. Others try to enter foreign markets by either investing in or outright buying startups in the US, the UK, and other countries. Chinese Internet giant Tencent invested in India’s unicorn BYJU’s and China’s TAL Education acquired Israel’s CodeMonkey, to name a few such deals.

So, it may well be that although certain investments are counted towards particular countries, it is essentially Chinese capital that we are talking about here, and those investments can be traced back to China-based parent companies.

Here is a list of Global EdTech Unicorns in 2020 from Holon IQ:

| Company | Country | Valuation |

|---|---|---|

| ByJu’s | India | $10.0B+ |

| Yuanfudao | China | $7.8B |

| Zuoyebang | China | $6.5B |

| VIPKid | China | $4.5B |

| Coursera | USA | $2.5B |

| Udemy | USA | $2.0B |

| Duolingo | USA | $1.5B |

| Unacademy | India | $1.45B |

| ApplyBoard | Canada | $1.4B |

| Course Hero | USA | $1.1B |

And here are Top ten investments of 2019 by Metaari:

| Company | Country | Funding amount |

|---|---|---|

| TAL Education | China | $500,000,000 |

| Niantic | USA | $435,000,000 |

| Zhihu | China | $434,000,000 |

| Zhangmen | China | $350,000,000 |

| Click Therapeutics | USA | $300,000,000 |

| Yuanfudao | China | $300,000,000 |

| KnowBe4 | USA | $350,000,000 In Two Rounds |

| Automattic | USA | $300,000,000 |

| Celonis | Germany | $290,000,000 |

| Magic Leap | USA | $280,000,000 |

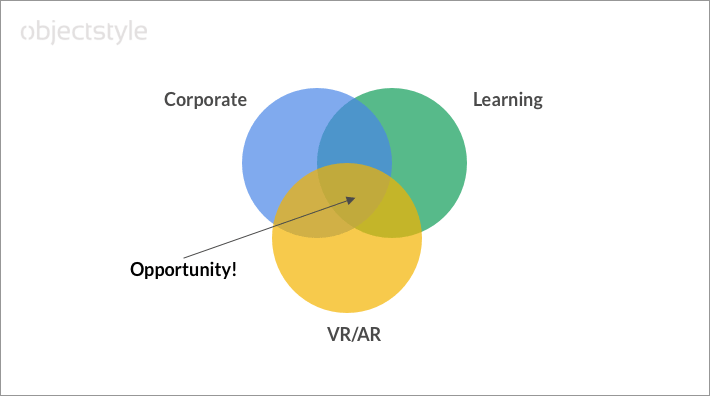

If you look at the above list by Metaari, you see Niantic and Magic Leap there. Niantic is the creator of Pokémon GO, and Magic Leap makes next-generation AR gear. The reason they are considered ed-tech startups is that both have seen little commercial success in the consumer-facing market and are now eyeing the corporate training sector for deals. As per Metaari:

After burning through funding and experiencing dismal headset sales in the consumer segment, they pivoted to the business segment in late 2019. They now have dozens of reseller partners (mostly content developers) that compete in the corporate segments across the planet.

So there is now opportunity at the intersection of corporate, learning/training/simulation, and VR/AR. The fact that major mixed-reality gear makers like Facebook (Oculus), Microsoft (HoloLens), and Google (Glass Enterprise Edition 2) are now focusing on catering to companies rather than individuals suggests the tech is in demand and comes useful for purposes like corporate training, product co-creation, design collaboration, and others.

EdTech Trends

Across industry reports, there seems to be a lot of interest in AR/VR technologies, AI, and gamification of education. Metaari refers to long-established ed-tech products like eLearning as “legacy tech” and points out that both investors and entrepreneurs have now shifted their interest to next-generation solutions like robotics or neuroscience-based learning.

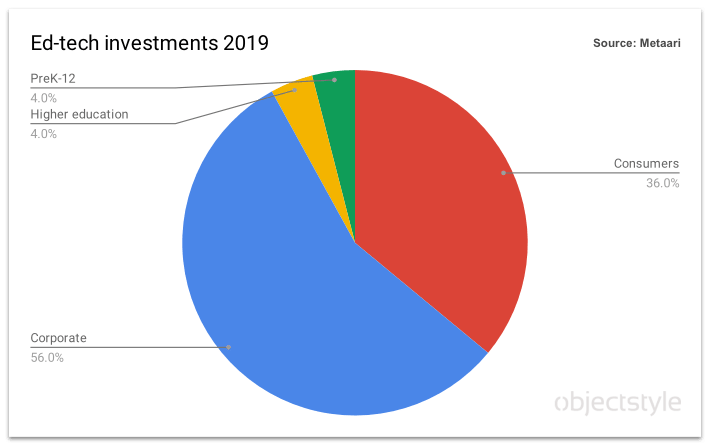

1. A spike in funding to corporate-facing products

In 2019, the corporate sector accounted for astonishing 56.0% of all learning-related investments.

If we look at what kind of products they were, we’ll see many solutions for AR/VR-based training and collaboration like Magic Leap. Smart corporate knowledge systems are also on the rise (that’s probably why Lucidworks was also on the list of “AI-powered learning” startups). These systems help companies bring all internal knowledge under one roof, tap into this pool for smart answers, and automatically redirect questions to the right people who might have the answers.

2. The rise of gamification and cognitive learning

Cognitive learning, immersive learning, and game-based learning have been all the rage recently. Investments in these technologies jumped from $51 million in 2012 to $2,250 million in 2019, with 2019 being the best year for game-based tech yet. To illustrate this with an example, at the start of 2019, India’s ed-tech giant BYJU’S acquired US-based Osmo (Tangible Play), a popular play-to-learn platform.

Gamification solves an important problem – the motivation problem – of learning. With the technology now ready to provide experience-based education, the number of companies that use this approach will only increase in the future.

3. Taking the mobile-first approach

According to Holon IQ (emphasis added):

With 90% of the world’s population under 30 living in emerging markets, education and vocational training in the area will be led by mobile-first strategies that provide knowledge and skills when and where they’re needed.

There are expected to be 2.7 billion students worldwide by 2035. Many of them will live in emerging economies where most people’s first computer is their smartphone. And this huge potential workforce will need to be educated – in a fast, flexible, and mobile way.

An enormous number of new and radically different jobs will emerge by 2025, and consequently, there will be a growing need to continually re-train the workforce in order to address current skill gaps and increase the use of continuous learning.- says the Holon IQ report.

TL; DR

Education is a $6 trillion industry, but only 2.6% of that money ($152 billion) is spent on technology. However, considering the growing popularity of immersive learning solutions such as game-based learning, mixed-reality learning, robot-aided learning, and others, ed-tech might be in for a sharp take-off.

The biggest investments in ed-tech have been occurring in China, India, and the US this year. And 56% of all venture funding went to corporate-facing products such as VR/AR-powered training systems and question-answering knowledge systems. The main trend is the waning interest in traditional learning models like self-paced eLearning and the growing interest in next-generation educational models like cognitive learning, VR/AR- and AI-based learning.

Related Blogs

Online learning: out-of-the-box platforms vs custom-made solutions

LEARN MORE